Welcome To

Alex Hwang's Portfolio

I am a Product Manager, software engineer and former financial investment professional and who is looking to add value to your group through both my technological technical capabilities and my financial markets experience and knowledge.

Product Managment Portfolio

Napkin

Napkin is a social media MERN application that allows users to create, manage and interact with various user investment portfolios with the goal of helping investors make quicker, more informed decisions by enabling a user to easily and accurately measure portfolio risk and return to beat market benchmarks.

- Mongo

- Express

- React

- Node

- Redux

- Material UI

Software Engineering Portfolio

Napkin

Napkin is a social media MERN application that allows users to create, manage and interact with various user investment portfolios with the goal of helping investors make quicker, more informed decisions by enabling a user to easily and accurately measure portfolio risk and return to beat market benchmarks.

- Mongo

- Express

- React

- Node

- Redux

- Material UI

CryptoViewer

CryptoViewer is an application that utilizes React, Redux, Rapid API and Ant Design. The application allows users from to view and serach the latest and most up to date information on the current Cryptocurrencies, exchanges and news.

- React

- Redux

- JavaScript

- Ant Design

SpaceX Rocket Viewer

SpaceX Rocket Viewer is an application that utilizes React, Redux, GraphQL, Apollo and Sass. The application allows users to view SpaceX’s previous launches and view the different equipment utilized for the launch of their rockets.

- React

- Redux

- GraphQL

- Apollo

- Sass

eCommerce ProShop

ProShop is an application that utilizes Django, REACT, AWS(S3, EC2 & RDS) and PostgreSQL with a full featured shopping cart with PayPal & credit/debit payments, product rating & review system, admin area to manage customers, products & orders, product search, carousel and pagination

- React

- Django

- AWS

- PostgreSQL

- Bootstrap

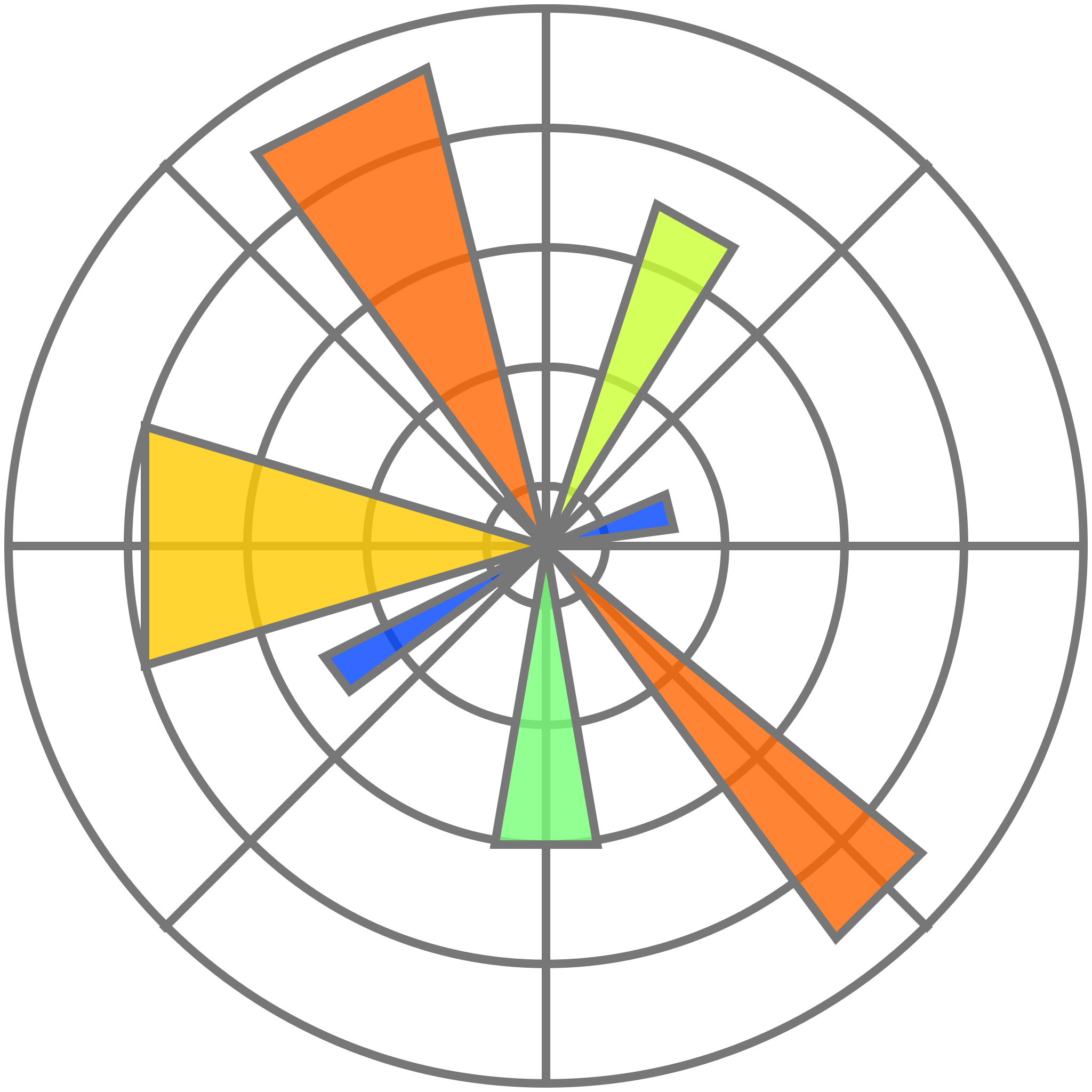

Arbitrage Mean-Reversion Trading Strategy

The Arbitrage Trading workbook utilizes a mean-reversion model to take advantage of pricing inefficiencies between a group of correlated securities. The workbook utilizes concepts of correlation, integration, stationary tests, spreads and ratios.

- Jupyter

- Pandas

- Numpy

Technologies

I've worked with a range a technologies in the web development world. From Back-end To Design

Front-End

Experiece with:

React

React Redux

Redux JavaScript

JavaScript Apollo

Apollo NextJS

Back-End

Experience with:

Python

Python Django

Django AWS

AWS MongoDB

MongoDB PostgreSQL

PostgreSQL GraphQL

GraphQL Express

ExpressNodeJS

Pandas

Numpy

Numpy MatplotLib

MatplotLibUI/UX

Experience with:

Material UI

Ant Design

Sass

Sass Figma

Figma

About Me

My name is Alex and I am product manager with experience in finance and software engineering. I have 8 yrs + experience in creating B2B and B2C Fintech products in generating revenue for investors through the creation and sales of various financial products.

I was in charge of managing and launching a B2B SAAS product that helped reduce our groups' investor and SEC reporting by 50%. The product was a data-driven investment management SaaS system used for portfolio management, investor reporting and business intelligence. I drove the product vision and roadmap, wrote user stories. The business intelligence system helped decrease expenses by 30%.

In my previous career as an investment analyst and Product Manager, I was a key contributor in leading a GTM strategy to create new investment products and marketing campaigns which led to the generation of an 80% increase in new users/investors and led to the fund growing Assets Under Management by 125% from $2 billion to $4.5 billion and 50% annual growth in fund topline revenue.

In addition, I am well versed in software engineering as I have built several apps and a fintech product that was able to gain 1000 early adopters in a 3 month time span.

I'm interested in taking my talents to a product manager role at an innovative technology or fintech company where I could apply my product leadership, technology, strategy and investment skills to create revenue generating products with exceptional user experiences..

Jan 2011

Musician/Guitarist/Audio Engineer

Jan 2013

Started my journey in finance as a Commercial Real Estate Analyst for Union Bank

Mar 2015

Joined Wells Fargo as a Private Equity Analyst

Jul 2017

Worked as an Investment Associate for Griffin Capital

Jun 2021

Began Learning JavaScript and Python

Sep 2021

Shared my projects with the world

Education/Certifications

University of California, San Diego

Bachelor of Arts, Economics, June 2011

Chartered Financial Analyst (CFA) I

Passed June 2019

Work Experiece

Investment Associate

Griffin Capital ▪ Los Angeles, CA ▪ July 2017 - July 2021

• Constructed and managed both a Private Credit and Real Estate Fund of Funds portfolio consisting over $50 billion of invested assets and $4 billion in committed capital with a focus on generating high idiosyncratic and risk adjusted returns.

• Assisted in the closing of 25 investments. Portfolio investments included primary and co-investments in Private Equity Funds, Senior and Subordinated Loans, Preferred Equity, and Commercial Real Estate.

• Built and created investment memos, models, dashboards and Business Intelligence System for prospective investments and data collection of prospective and current investments.

• Performed research around new investment areas, strategies, fund managers, portfolio construction and product development.

Private Equity Analyst

Wells Fargo Securities ▪ Irvine, CA ▪ March 2015 - July 2017

• Invested in 80 funds, $1.2 billion committed capital with $20 billion invested in 1,253 portfolio companies.

• Assisted in the closing of 15 investments. Investments included investments into Private Equity, Venture Capital, Debt and Real Estate funds and various Co-Investments.

• Reviewed and built various investment models including private equity fund models and leverage buyout models.

• Participated and led screening of due diligence meetings with new and existing investment opportunities.